“Repaying Student Loans After Graduation: Navigating the Challenges of Loan Repayment”

Graduating from college is a significant milestone, but for many students, the next challenge they face is repaying their student loans. With the rising cost of tuition and related expenses, student loan debt has become a growing problem in the United States. The average student loan debt per borrower in the US is over $30,000, and with high unemployment rates, many graduates are struggling to find jobs that allow them to make payments on their loans.

The first step to repaying student loans is to understand the terms and conditions of your loan. It’s essential to know the interest rate, the repayment period, and the monthly payment amount. You should also familiarize yourself with any repayment options that are available to you, such as income-driven repayment plans, which can help reduce your monthly payments based on your income.

One of the biggest concerns for graduates is finding employment after graduation. With unemployment rates still high in many areas, it can be difficult to find a job that pays enough to cover your monthly loan payments. If you are struggling to find a job, consider taking on freelance work or part-time work to help make ends meet. You may also be eligible for unemployment benefits, which can help you stay afloat while you search for a full-time job.

If you do find a job but are still struggling to make your loan payments, consider enrolling in an income-driven repayment plan. These plans are designed to make your loan payments more manageable by tying them to your income. For example, if you are making a low income, your monthly loan payments will be lower, and if your income increases, your payments will increase as well.

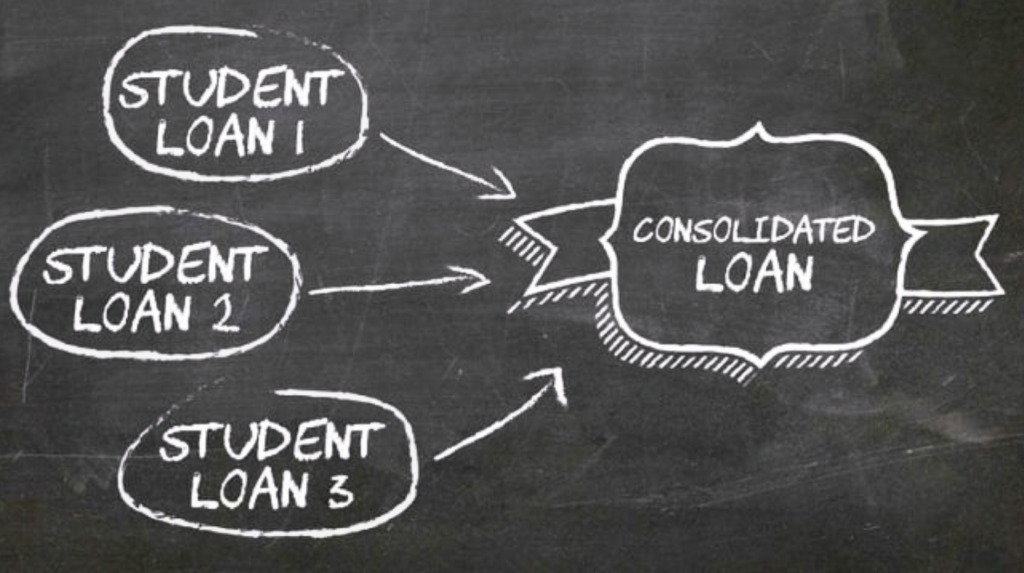

Another option for graduates who are struggling to repay their loans is loan consolidation. This involves taking out a new loan to pay off your existing loans, which can help simplify your loan repayment and potentially lower your monthly payments. However, it’s essential to understand the terms and conditions of a consolidation loan before you decide to move forward with this option.

Deferment or forbearance is also another option for graduates who are struggling to make their loan payments. This allows you to temporarily stop making payments on your loans, which can give you some breathing room if you are struggling to make ends meet. However, it’s essential to understand that interest will continue to accrue during the deferment or forbearance period, which can increase the overall cost of your loan.

Finally, if you are struggling to repay your loans, consider reaching out to your loan servicer for assistance. They may be able to help you find a repayment plan that works for you or connect you with resources that can help you manage your debt.

In conclusion, repaying student loans after graduation can be challenging, especially if you are facing difficulty finding employment. However, there are options available to help you manage your debt and stay on track with your loan repayment. From income-driven repayment plans to loan consolidation and deferment, there are solutions that can help you navigate the challenges of loan repayment. Remember to stay informed, reach out for help when you need it, and stay focused on finding the solution that works best for you.